Australia’s Public Practice Accountancy Sector – Scale, Characteristics & Challenges

Australia’s Public Practice Accountants – An Overview

Australia's public practice accountancy sector is estimated to comprise in excess of 30,000 practices, with annual revenue in the vicinity of $17 billion. Industry concentration is low with the 'Big Four' (Deloitte Touche Tohmatsu, KPMG, Ernst & Young/EY, and PricewaterhouseCoopers/PwC) representing just under 20% of the overall marketplace (Chia, 2014, pp. 3, 24-28). 'Second-Tier' providers (approximately 50 firms) represent a further estimated 17% of the market (Khadem, 2012, pp. 1-6). The balance of the sector (third tier and beyond, shall we say) therefore numbers around 30,000 practices and accounts for approximately 60% ($10 billion p.a) of the overall market. These practices would generally indicate that they primarily service Australia's small and medium-sized enterprises (SMEs), high net-worth individuals, and tradespeople with their tax-compliance requirements.

This paper is best read in conjunction with 'Reviewing the Australian Public Practice Accountant – SME Relationship. Do SMEs Believe Their Public Practice Accountant Is Their Most Trusted Advisor?' (RAFFREY insight, Autumn 2014).

Public Practice Accountants Challenges – Macro Level

The following summary of success factors is drawn from the respected industry-reporting organisation, IBIS World (Chia, 2014, p. 19):

- Ability to effectively manage risk

- Membership of an industry association

- Maintenance of excellent customer relations

- Establishment of brand names

- Experienced workforce

- Optimum capacity utilisation

Additionally, Business Fitness has identified the following top challenges for Australian accountancy practices (Business Fitness, 2012, p. 27):

- Growth

- Efficiency of firm processes

- Management of workflow

- Getting new clients

- Keyperson dependence

- Write-offs

- Profitability

- Management of debtors

- Standardisation and consistency of firm processes

- Productivity

- Managing client relationships

- Introducing new services

It is interesting to note how many of the challenges and success factors above relate to operational (or practice-facing) matters – rather than client-facing issues. This is typical of a marketing orientation that favours the production concept.

'Production Concept – The idea that consumers will favour products that are available and highly affordable, and that the organisation should therefore focus on improving production and distribution efficiency.' (Armstrong et al., 2012, pp. 10-27)

Contrast this approach with the more developed orientations of the product concept, selling concept, marketing concept, and societal marketing concept. If we allow ourselves to consider the above concepts as a continuum, the production concept (whilst still relevant) could be considered to be the least sophisticated, from a client standpoint.

Public Practice Accountants Challenges – Micro Level

Through engagement with public practice accountants who service the SME space ('third tier and beyond'), we have developed an understanding of common issues facing these practices. Such engagements usually commence with a comprehensive review of the practice. This covers: principals, partners, senior managers, and staff, and takes them through a structured question-and-answer process that embraces every aspect of practice operations.

We have identified common and consistent themes as a result of the comprehensive practice reviews of these third-tier public practice firms. These themes can be largely summarised as the need for:

- Market Development – which includes; the need to better understand the make-up of existing and preferred clients – preferred segmentation and targeting bases, the need to have clarity around the practice’s client offerings and marketplace positioning, processes for existing client management, and new client development.

- People Development - including the development of a robust organisational structure in support of the practice, development of hard-and-soft skills requirements within the practices, HR systems (well-defined position description, KPIs, performance review and development processes, training…), skills and experience spread across the practice.

Experience in the public practice space has led us to conclude that the Market Development shortcomings (identified above) mean that there is often not a strong-enough understanding of the reasons why clients are serviced, and not sufficient clarity on the level and nature of service offering.

Indeed, there is often a lack of understanding of service levels provided to clients, and of feedback mechanisms to measure actual service performance.

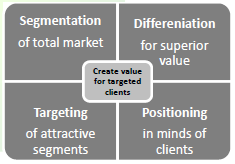

The most fundamental of marketing tenets is the need to develop a client-driven market strategy (Armstrong et al., 2012, p. 184) and it is described as follows:

Figure 1. Client-driven marketing strategy (Armstrong et al., 2012, p. 184)

Such a strategy requires explicit decisions around the selection of clients to serve (segmentation and targeting), as well as decisions on the practice’s value proposition (differentiation and positioning). Experience suggests that many public practice accountants encounter difficulties in explaining how they achieve the above for their practices. Therefore, a reasonable conclusion is that the delivery of client value could well be suboptimal. It could still mean that the accountant remains the SME’s most trusted advisor, but does it actually pass the materiality, or 'so what' test?

SMES AND TRUST

Anecdotally and consistently, business owners have acknowledged the important role played by their public practice accountants. However, this feedback often centres on compliance matters (tax returns and financial accounts, for example), rather than improvement and development initiatives. When client work moves beyond this compliance activity, it still tends to remain in a very narrow financial band.

Many business owners have shared their desire to have someone within, or close to, the business they trust to sanity check or get perspective, on initiatives and ideas. Is this the role of, or an opportunity for, the public practice accountant? Or should this task be left to the business coach, management consultant, non-executive director, or indeed advisory board member(s)?

It is interesting to note that the website of nearly every public practice accountant includes the words 'consulting' or 'business advisory' or something equivalent. Is there a disconnect between what this actually means to the accountant and what SME clients might require? This needs to be explored to establish answers satisfactory to both parties.

References

Armstrong, G., Adam, S., Denize, S., & Kotler, P. (2012). Principles of Marketing (5th ed.). Melbourne, Victoria: Pearson Australia.

Business Fitness. (2012). The Good, the Bad and the Ugly of the Accounting Profession (Australian Edition).

Chia, S. (2014). Accounting Services in Australia. Melbourne, Victoria: IBISWorld.

Khadem, N. (2012). Accounting 100: The Fight for the Top. The Australian Financial Review. Retrieved from https://www.brw.com.au.

CONTACT US

WOULD YOU LIKE TO LEARN MORE?

IMPORTANT NOTICE

Information contained in this document constitutes general comments only for the purposes of education, and is not intended to constitute or convey specific advice. Clients should not act solely on the basis of the material contained in this document. Also, be aware that changes in relevant legislation may occur following publication of this document. Therefore, we recommend that formal advice be obtained before taking any action on matters covered by this document. This document is issued as a guide for clients only, and for their private information. Therefore, it should be regarded as confidential, and should not be made available to any other person without our prior written approval.